USPS PS Form 8125 2007-2025 free printable template

Show details

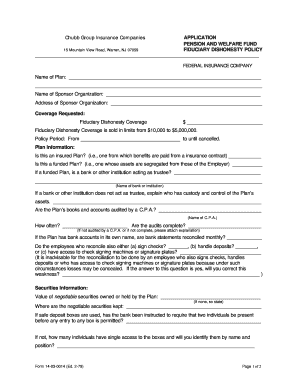

PS Form 8125 is not required for PVDS mailings sent via Express Mail or Priority Mail Open and Distribute. Complete the Destination section items 29 through 34 legibly. Retain PS Form 8125 in your files for 1 year. In item 15 you may show other mailer information for example sequence number for a postage statement manifest or PS Form 8125. PS Form 8125 July 2007 NSN 7530-02-000-7255 Page 1 of 2 Destination Office 1 Mailer 2 Mailer Complete original and make 2 copies. Submitting Mailing and PS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign trial form 8125

Edit your usps ps form 8125 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usps form 8125 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usps form 8125 mium online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to usps drop shipment form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out postal form 8125 trial

How to fill out USPS PS Form 8125

01

Obtain USPS PS Form 8125 from the USPS website or your local post office.

02

Begin filling out the form by entering the date at the top of the document.

03

Provide the name and address of the mailer in the designated section.

04

Fill in the details of the shipment, including the type of mail, weight, and dimensions.

05

Indicate the total postage paid for the shipment.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form along with the mail item to your local post office.

Who needs USPS PS Form 8125?

01

Individuals or businesses that are sending bulk mail or merchandise through the USPS.

02

People offering incentives or discounts for mailings that require special handling.

03

Mailers who need to document the postage and shipping details for record-keeping or auditing purposes.

Video instructions and help with filling out and completing usps form 8125 fillable

Instructions and Help about postal service form 8125

Fill

usps drop shipment form

: Try Risk Free

People Also Ask about 8125 pdf

What is drop shipment authorization?

A drop shipment is a transaction where a seller accepts an order from a customer, then places the order with a third-party supplier – typically a manufacturer or wholesale distributor – and directs the manufacturer to ship the goods directly to the customer.

What is a USPS drop shipment?

Drop Shipping is where a mailer moves their mailing to a postal facility closer to the destination before handing it over to the Postal Service. The further downstream mail is entered into the system, the greater the postage discount given to the mailer.

What is USPS Form 8125?

PS Form 8125 is used to report a single PVDS that the mailer will transport from origin to a destination facility. PS Form 8125 proves to the destination facility that the mail presented by the mailer was verified and paid for at origin.

What is USPS PVDS?

Plant-verified drop shipment (PVDS) enables origin verification and postage payment for shipments that a mailer transports from the mailer's plant to destination Post Offices™ where the prepaid and pre-verified shipments are accepted by the Postal Service™ as mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify trial us postal service form 8125 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your plant verified drop shipment into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute usps drop shipment form online?

Filling out and eSigning postal service form 8125 trial is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out post ps verified online on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 8125 trial from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is USPS PS Form 8125?

USPS PS Form 8125 is a form used by the United States Postal Service to report the results of a Postal Service delivery option analysis and is mainly utilized for documenting USPS's non-standard rates and services.

Who is required to file USPS PS Form 8125?

Clients who apply for non-standard rates and services or those involved in business transactions requiring documentation of postal service conditions are required to file USPS PS Form 8125.

How to fill out USPS PS Form 8125?

To fill out USPS PS Form 8125, you need to provide the basic information regarding the sender and recipient, specify the type of service requested, indicate the applicable postal rates, and sign the form to confirm the accuracy of the information.

What is the purpose of USPS PS Form 8125?

The purpose of USPS PS Form 8125 is to facilitate proper documentation and reporting of specific postal services, ensuring compliance with USPS regulations and providing a basis for billing and service delivery.

What information must be reported on USPS PS Form 8125?

USPS PS Form 8125 must report details including sender and recipient information, service type, applicable rates, and additional services required, along with any relevant signatures and dates.

Fill out your USPS PS Form 8125 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

And Ps Form 8125 is not the form you're looking for?Search for another form here.

Keywords relevant to usps postal form 8125

Related to printable 8125 usps form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.